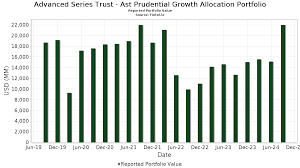

How Advanced Series Trust Can Enhance Your Estate Planning Strategy

Estate planning is a critical process that requires careful consideration of your assets, beneficiaries, and wealth’s future. It’s about more than just drafting a will – it’s about setting up structures that protect your wealth, minimize taxes, and ensure that your legacy is passed on according to your wishes. One of the most effective tools available for estate planning is the Advanced Series Trust (AST). This sophisticated financial vehicle offers a range of benefits that can significantly enhance your estate planning strategy.

This article will explore how Advanced Series Trusts work, their advantages, and why they are a powerful tool in modern estate planning.

What is an Advanced Series Trust?

An Advanced Series Trust (AST) is a trust structure commonly used by high-net-worth individuals, business owners, and others with complex financial needs. It is a legal entity that holds assets on behalf of beneficiaries, with specific instructions on how those assets should be distributed or managed after the trust creator (also known as the grantor) passes away.

What makes the AST unique is its ability to combine the features of various trust types, such as protecting assets, maintaining privacy, and minimizing taxes while offering greater flexibility and control over how assets are managed. Unlike traditional trusts, ASTs can provide additional layers of protection for beneficiaries by isolating risks associated with specific investments or business ventures.

How Does an Advanced Series Trust Work?

An Advanced Series Trust operates similarly to other types of trusts in that it involves a legal agreement between the trust creator (the grantor), the trustee (who manages the Trust), and the beneficiaries (who receive the assets). However, what sets the AST apart is its structure and the additional benefits it provides.

The AST generally consists of a master trust, which can be subdivided into multiple series. Each series within the master trust is a separate and distinct entity with its own set of assets, liabilities, and beneficiaries. This separation of assets within the Trust allows for increased asset protection and flexibility, particularly when the grantor has a wide variety of assets, including business interests, real estate, investments, and personal property.

Using an Advanced Series Trust, you can assign different assets to different series based on their level of risk or importance. For example, you place high-risk investments in one series and low-risk assets in another. This structure helps minimize the potential for loss and ensures that the estate planning process can be tailored to your unique needs.

Benefits of Using Advanced Series Trust in Estate Planning

Asset Protection

One of the most compelling reasons to use an Advanced Series Trust is its ability to provide robust asset protection. The AST’s structure ensures that assets within each series are isolated. If one series faces a lawsuit or financial trouble, the different assets within the Trust are shielded from creditors or other claims.

This level of protection can be invaluable for individuals with significant wealth or those who own businesses. For example, if a company you own is sued, the assets in other trust series may remain untouched, helping preserve your wealth.

Estate Tax Reduction

Advanced Series Trusts can also be used strategically to minimize estate taxes. By placing assets into an AST, you are effectively removing those assets from your taxable estate, which can reduce the overall tax burden on your heirs.

In addition to removing assets from the taxable estate, an AST can provide flexibility when making gifts to beneficiaries. For example, you can create a series within the Trust designated for charitable giving, allowing you to donate assets without incurring significant tax liabilities.

Privacy and Confidentiality

Unlike probate, a public process, trusts allow for the private distribution of assets. Since an AST is a private entity, it bypasses the probate process, ensuring that your financial affairs remain confidential.

For high-net-worth individuals who value their privacy, this feature is particularly beneficial. An AST allows you to control who sees your estate plan and how your wealth is distributed, ensuring that your wishes are carried out without public scrutiny.

Flexibility in Asset Distribution

Advanced Series Trusts offer unparalleled flexibility in how assets are distributed to beneficiaries. Instead of a one-size-fits-all approach, you can customize how each trust series is handled. You can specify different distribution rules for other beneficiaries, ensuring that the right people get the right assets in the right way.

For example, you may provide one beneficiary with income from a particular series of trusts while leaving another beneficiary with the principle after a certain period. This level of customization ensures that your wishes are accurately followed and that your loved ones are supported in a way that meets their specific needs.

Business Succession Planning

For business owners, an Advanced Series Trust is an excellent tool for business succession planning. If you own a business and want to pass it down to your heirs, an AST can help protect the company from any financial or legal challenges that might arise during the transition.

By placing the business into a series within the Trust, you can ensure that the company’s ownership is passed on smoothly and remains protected from creditors. This allows for continuity and stability during the succession process, giving you and your heirs peace of mind.

How to Set Up an Advanced Series Trust

Setting up an Advanced Series Trust requires careful planning and expert advice. Working with an experienced estate planning attorney or a financial advisor who understands the complexities of ASTs is essential. Here are the general steps involved in setting up an AST:

- Consult with a Professional The first step in setting up an AST is to consult a qualified attorney or estate planner who can assess your specific needs and determine whether an Advanced Series Trust is appropriate for your situation.

- Establish the Trust Once you’ve decided to move forward, you’ll need to establish the Trust. This involves drafting the trust agreement, which outlines the terms, the trustee’s responsibilities, and the distribution rules for the beneficiaries.

- Fund the Trust The next step is to transfer assets into the Trust. This can include business interests, real estate, investments, or other valuable assets. Each series within the Trust can be designated for different types of assets, depending on your preferences.

- Ongoing Management After the Trust is set up and funded; the trustee will manage the assets according to the terms of the Trust. Regular updates and adjustments may be needed to ensure that the Trust continues to meet your goals.

Conclusion

An Advanced Series Trust is a powerful tool for individuals looking to enhance their estate planning strategy. With benefits ranging from asset protection and tax reduction to privacy and flexibility in asset distribution, an AST can help ensure your wealth is managed and passed on according to your wishes. Whether you’re a business owner, a high-net-worth individual, or someone with a complex estate, an Advanced Series Trust can provide the structure and security you need to protect your legacy and secure your family’s financial future.

Frequently Asked Questions (FAQs)

1. What makes an Advanced Series Trust different from a traditional trust?

An Advanced Series Trust (AST) differs from a traditional trust’s ability to separate assets into distinct series within a master trust. This provides increased flexibility, asset protection, and customization in managing and distributing assets, offering significant advantages for those with complex financial situations.

2. Can an Advanced Series Trust help reduce estate taxes?

An AST can help reduce estate taxes by removing assets from the taxable estate. The trust structure allows assets to be transferred to beneficiaries with minimal tax liability, providing an effective strategy for tax reduction in estate planning.

3. How does asset protection work in an Advanced Series Trust?

Each series within an AST is treated as a separate legal entity, meaning that assets held in one series are protected from creditors or claims against other series. This provides robust asset protection, particularly valuable for business owners or those with high-risk investments.

4. Is an Advanced Series Trust suitable for everyone?

While an Advanced Series Trust offers significant benefits, it is generally most suitable for high-net-worth individuals, business owners, or those with complex estates. It’s best to consult an estate planning attorney to determine if an AST is right for your needs.

5. How do I set up an Advanced Series Trust?

Setting up an Advanced Series Trust involves consulting with a qualified estate planner or attorney to assess your needs, establishing the Trust, transferring assets, and ongoing trust management by a designated trustee.

You May Also Read: https://techusupdate.com/spellcheckgame/